Kicking Off Q4 With A Quantitative Data, Pop Culture Overload

Best/Worst stock tables for October and Q4, plus revisiting our Top Picks of 2025

We Didn’t Start the Fire

Short squeeze, winning streaks

TrumpRX, AI peaks

Options boom, buy the dip

Retail takes another trip

Bears hitting exits fast

Momentum plays built to last

Bond yields rising every day,

Seasons just a game we play

D.C. dysfunction, VIX without compunction

Record closes, win streaks,

Gold prices all-time peaks

Bitcoin’s going vertical,

Shutdown talk is back for more

I can’t take it anymore!

(we love you Billy Joel. btw that was all me, ChatGPT just fixed the structure)

Don’t let a government shutdown, parabolic growth stocks, and Taylor Swift’s new album distract you from the fact that we’re somehow, some way, in the fourth quarter of 2025. It feels like yesterday we were looking at those (now) April lows and buckling our seatbelts.

Now…

It’s pure comedy at this point. These companies with very vague fundamentals keep swelling up, consolidating, then finding the next leg higher. Rinse and repeat, no matter the macro backdrop.

This isn’t some whining, I-missed-out-so-I’m-lashing-out ranting. We’ve been very vocal on the interwebz and with our products at Schaeffer’s about some of these growth names. (And we’ve got a CVS-length receipts below to prove it)

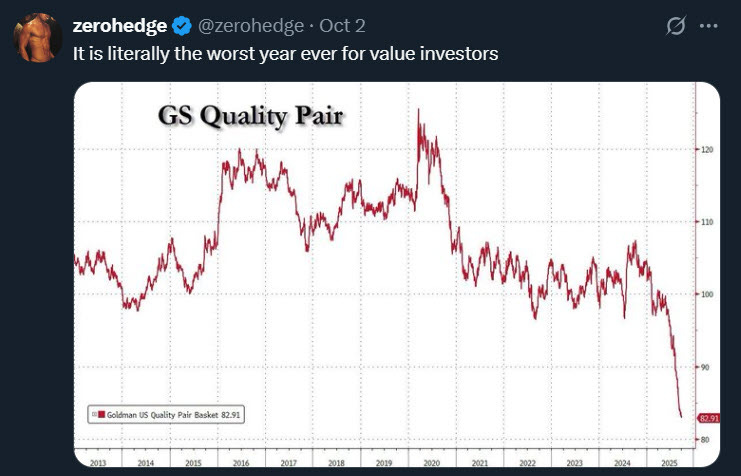

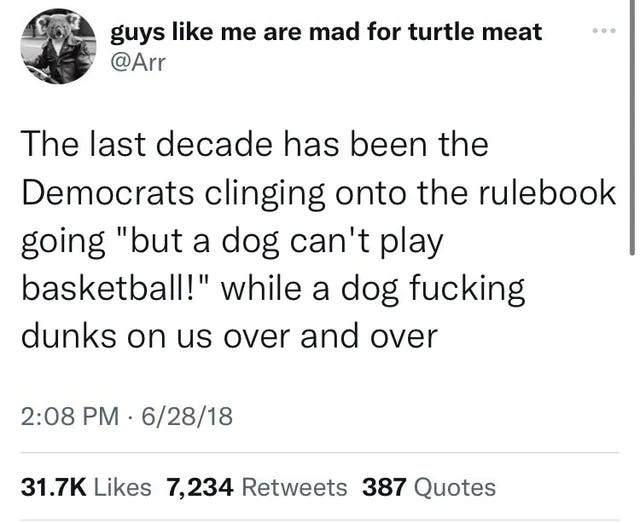

The whole hand-wringing over valuations and bubble doomerism reminds me of this tweet:

That’s how those crying wolf sound right now. And the crazy thing is, they’re probably right. But they’re also kind of missing the point?

There’s no point in complaining about stocks barreling past swelling valuations, overbought relative strength, and negative balance sheets, because that’s not the game anymore! Its clear that part of the rulebook has been thrown out. Adapt or die.

If you’re sitting on the sidelines calling foul while everyone else makes money hand over fist, that’s a skill issue. Here’s the important part that I want you to read twice: Two things can be true at the same time. Yes, these melt ups are batshit insane, scary, and probably temporary. Howevah, you’d also be a fool for not taking a flier on a few of these names.

Always have an exit strategy, watch for the signs (cough cough keep reading), but in the meantime, enjoy your time in the money machine.

Enough shitposting edgelord rambling. Let’s get to some actionable info.

Best/Worst Stocks to Own This Month

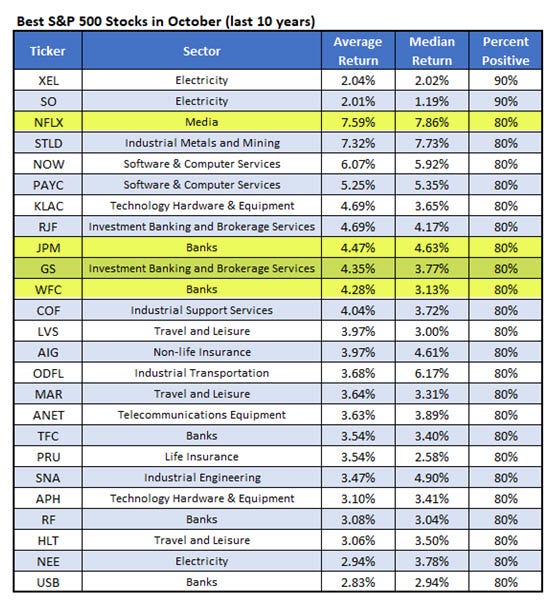

Rocky White, if you’re reading this, we love you. Our Quantitative Analyst always delivers, and this week is no different. Below are his Best/Worst tables for October and Q4.

What stands out? Netflix (NFLX) leads the list, and with a 10% drawdown in the last three months, could be a buy-the-dip candidate, if that’s your sort of thing.

JPM reported earnings in October for the last two years, both of which were post-earnings pops (1.5%, 4.4%). Ditto Goldman Sachs (GS), Wells Fargo (WFC), and all the other bank stocks populating this list.

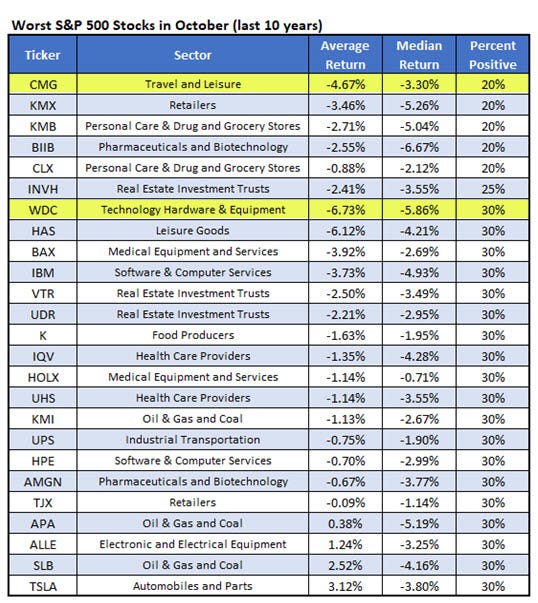

Dark and ominous tones for Western Digital (WDC), which has been lighting up the charts lately, but did step to the sidelines this week.

It can’t get much worse for Chipotle Mexican Grill (CMG), can it? Despite a 3.7% gain on Friday, CMG is down 30% in 2025, hit a multi-year low of $38.31 on Sept. 11, and is heading into historically bearish month and quarter.

The ETF table is too long to throw in here, but a quick shoutout to iShares Silver Trust ETF (SLV), the best-performing exchange-traded in October in the last decade, with an average return of 2.2% and 80% win rate. SLV is up 61% in 2025, riding golds’ coattails to record highs.

On the other side of the coin, iShares 20+ Year Treasury Bond ETF (TLT) is the worst-performer in the last 10 years, with an average October loss of 2.9% and a brutal 10% win rate. Bond yields popped after Wednesday’s ADP jobs data.

Noooooticing.

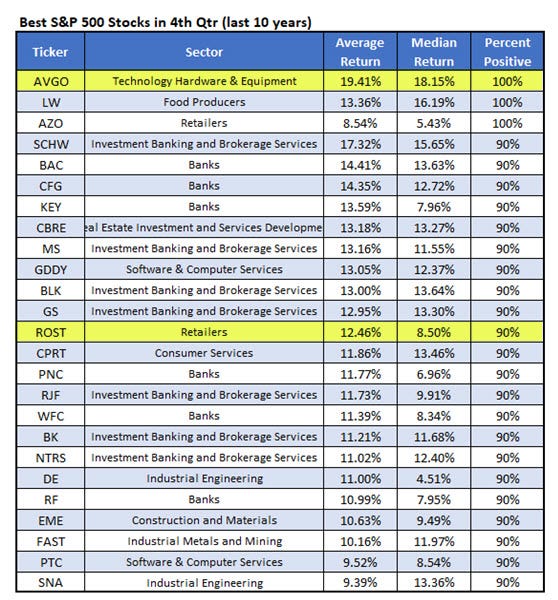

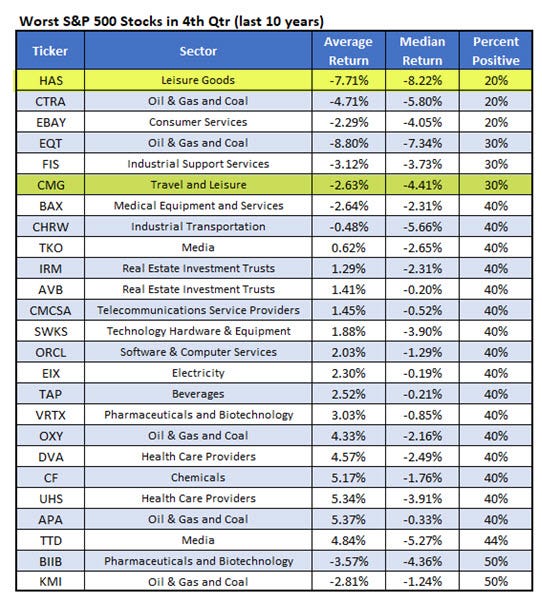

Best/Worst Stocks to Own This Quarter

Presented without comment.

Big quarter for banks, and similar to Netflix’s pullback and October seasonality, Broadcom’s (AVGO) historical success in sticking the landing to end years is flashing.

Not a lot of fun on this list. Hasbro (HAS) has the collectables corner that could pop during holiday shopping season, but has cheap options and a whole bunch of analysts digging in with “strong buy” ratings. Something to explore later, methinks.

Power Ranking Our Top 2025 Stock Picks…as Taylor Swift Eras

We’ve done these power rankings twice already in 2025, with two very different tones. The third quarter can best be described as:

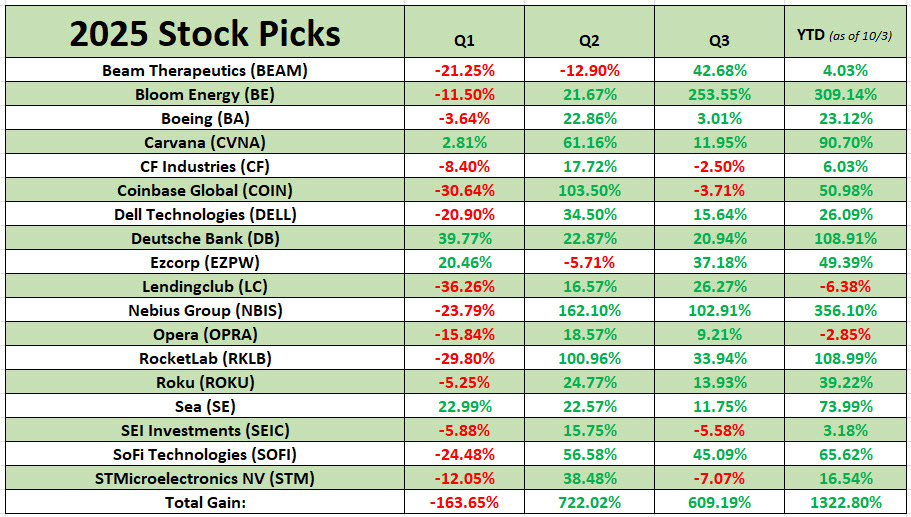

This report was sent out to subscribers to end 2024, as a list of stocks to buy and hold through the year. If you could stomach the brutal start to the year, congrats, you can now probably tell your boss to take a hike.

Since everyone (aka me) is a sucker for power ranking slop, we’ve compiled the 18 picks below by order of year-to-date gain, grouped by Taylor Swift eras, since I’m about to be hearing The Life of a Showgirl ad nauseam the next six months.

Figured I’d lean into it.

Reputation Era

(best stocks of the best, no skips)

Nebius Group (NBIS): Take a bow Reilly McAdams, who recommended this idea. You’ve now surpassed Rachel as everyone’s favorite McAdams. Nebius has been wheeling and dealing in the AI landscape, but 10% of the stock’s total available float is still sold short.

Bloom Energy (BE): A data center bubble beneficiary. Had to quadruple check that Q3 gain. Climbing even after a post-earnings breather of 1.8% in September. As of this writing, nearly 19% SI/F ratio.

Rocket Lab (RKLB): Been beating the earth exploration drum for a while now. Is that a bullish flag pattern forming amidst its month-long consolidation!? Brushed off $750 million stock sale, has technical support, and still contrarian potential (12.7% SI/F). Unironically, to the moon.

Folklore Era

(A little slower, but still packs a punch)

Deutsche Bank (DB): What’s this? A boring old bank stock? DB straight vibin, and a poster child for value investing.

Fearless Era

(Can see the vision)

Carvana (CVNA): Riding that 50-day moving average after a 17% post-earnings bull gap on July 31. Short interest down in most recent reporting period, but 8.7% SI/F.

Sea Limited (SE): One of only three names on the list with three-straight quarters in the black. Not eye-popping squeeze potential anymore, but chart support in place.

Red Era

(All over the place, some big swings)

SoFi Technologies (SOFI): Has taken a 16% haircut off its Sept. 22 record high, testing its 50-day moving average. With 9.8% SI/F, this one could have room to run still.

Coinbase Global (COIN): You know the drill with COIN, the crypto play. Still a lot of analyst skepticism.

Ezcorp (EZPW): Really like that bounce off its 200-day moving average back in late July. And with 16.4% SI/F, this and SOFI could be just getting started in fintech world.

Roku (ROKU): A former growth stock reinventing itself. A little oversold per its 14-day RSI.

Midnights Era

(Really like the look of these when you get down into the weeds)

Dell Technologies (DELL): Monitor the chip imports, tariff drama with this one. But could that be a little bull flag pattern forming?

Boeing (BA): See, we’re not all about growth stocks here! Pulling back, but still as of now in a channel of higher highs off those April lows.

STMicroelectronics NV (STM): Suffered a 15.9% post-earnings bear gap on July 24. Has slowly tried to fill that gap, to no avail.

Fearless Era

(Ready to break out)

CF Industries (CF): Just filled its own post-earnings drawdown of 7.7% in early August. Sneaky SI/F of 6.5. Defo an earnings to watch on Oct. 23, especially with 14/17 brokerages maintaining “hold” or “strong sell” ratings.

Beam Therapeutics (BEAM): Still working off the brutal first six months. But trading at its highest level since March right now, and has the highest SI/F% of our Top Picks. Don’t call it a comeback!

Debut Era

(Not my cup of tea, but has some potential)

SEI Investments (SEIC): Going in the wrong direction. Testing its 200-day moving average.

Opera (OPRA): Couldn’t take advantage of an early-September “buy” rating. Hasn’t gotten off the bus yet for Q4 (11% weekly loss).

LendingClub (LC): Really says something when your worst performer is only down 6.4% year to date, and is fresh off a 26.3% quarterly gain. Testing a historically bullish trendline, and an area that’s the site of its post-earnings bull gap from July 30.

BEAM, COIN, DELL, NBIS, ROKU, and STM all have 14-day Relative Strength Indexes of 70 or more. In Nebius’ case, the RSI sits deep in overbought territory at 88. But honestly, given the robust gains nearly all these stocks have wrought, I am surprised more aren’t in that “overbought” territory.

Maybe I’m a hopeless romantic, but there are cases to be made for all 18 of these names. We’ll catch up more on these in December.

Cash Me Outside

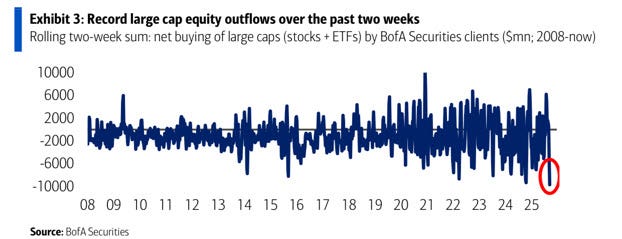

Senior Market Strategist Matthew Timpane flagged this on Thursday: Bank of America saw a record number of outflows over the past two weeks.

Joel Leon of Bloomberg added some more color to it. Two weeks ago, we hailed small caps and their role in September’s reverse seasonality.

Going by fund flows at the biggest exchange traded fund that tracks the Russell 2000, investors are pocketing profits almost as rapidly as they accrue. Some $5.4 billion has been pulled from the iShares Russell 2000 ETF this year, while the index it tracks has soared to an all-time high.

Will this trend of cashing out continue, eventually trip up buyers, and signal the end of the party? Or, as Matthew put it, “do we consolidate through time and ease through market risks, and then everyone realizes they should have never exited, and we squeeze further?

That’s the life of a showgirl, folks. Keep on keeping on.

This is absolutely brilliant stuff! The Taylor Swift era power rankings had me dying - "Rachel as everyone's favorite McAdams" is A+ banter. But seriously, the Billy Joel parody into "adapt or die" market philosophy is perfect. You're 100% right that two things can be true - these valuations are insane AND you'd be leaving money on the table by sitting out. The WDC call-out in the "Worst Stocks for October" table is particularly interesting with hindsight. This was written Oct 4, and WDC "stepping to the sidelines" proved to be a brief consolidation before absolutely ripping higher (currently ~$141). Rocky White's quantitative work flagged the historical headwinds, but the AI storage narrative was strong enough to overpower seasonal patterns. That's the whole "rulebook being thrown out" theme you articulated. Also really appreciate the fund flow analysis at the end - $5.4B pulled from IWM while the Russell hits ATHs is textbook "sell into strength" behavior. Matthew Timpane's question about whether we "consolidate through time" or "squeeze further" is THE question right now. Based on what we've seen, I'd bet on the squeeze continuing until something breaks. Your Top 2025 Picks update is impressive - even LC down only 6.4% as your "worst" performer is solid managment. NBIS, BE, and RKLB leading the pack validates the whole "infrastructure picks and shovels" approach. Keep this excellent work coming!